FAQ

RISE Task Force Frequently Asked Questions

The University has had a healthy financial outlook for years. What has changed?

Illinois State is part of a national and global ecosystem subject to the same pressures facing the entire higher education sector. Colleges and universities are under severe pressure on many fronts regionally, nationally, and internationally. Expenses are outpacing revenues at many small, midsize, and even large public and private universities. The cost of delivering a high-quality education continues to rise. Technological advances, facility enhancements, and the necessity for competitive compensation to attract and retain talented employees have all escalated operational expenses, as has the impact of inflation on everything from office supplies to utilities and construction costs.

What is Illinois State’s budget model?

Illinois State has had an incremental budget model for decades. Incremental budgeting is a traditional budget model in which budgets and allocations are based on previous year’s funding levels. Incremental models are sometimes referred to as historical budget models because they are based on prior allocations rather than current and future needs. This approach has led to budgets that are not aligned with current operational needs, limiting the University’s ability to manage its financial resources proactively and strategically.

What budget models are being considered?

A number of university budget models exist, including zero-based budgeting, activity-based budgeting, and performance-based budgeting, to name a few. Many universities don’t use a single budget model across the board but use different models for different programs and activities. ISU is partnering with external higher education consultants Grant Thornton to help assess our current budget practices. Once this analysis is complete, we should have a better understanding of the budget model or models that will best meet our needs as a university.

What is the enrollment cliff and how does it impact ISU?

The traditional college-age population is shrinking, especially in the Midwest and Northeast, increasing competition among institutions for a smaller pool of prospective students. Enrollments have been declining nationally for several years, and a steep decline is projected to hit colleges and universities in 2026 due to fewer students graduating from high schools. Nevertheless, Illinois State has remained a school of choice for students, as evidenced by our continued strong enrollment. To maintain strong enrollments in the face of increased competition for fewer students, ISU must continue developing programs that serve community needs and appeal to prospective students while at the same time strengthening our academic profile. While the University has been strategic in its enrollment growth, we must also plan for this growth to slow or even decrease in response to declining numbers of high school graduates in Illinois.

ISU has strong enrollment. How does that factor into our fiscal challenges?

While higher enrollments do provide additional revenue, it is not enough to cover projected cost increases in the general fund. Additionally, the historic funding formula for state appropriations is not tied to enrollment.

Was ISU aware of these challenges? Why didn’t we know about these earlier?

The long-term trends are not new information to the University. We have been proactively planning for the enrollment cliff by introducing new and expanded programs with the expansion of Mennonite College of Nursing, College of Engineering, the new School of Creative Technologies, and new majors such as Data Science, Public Health, and Online Business Administration. We have also implemented new and increased revenue streams through the Academic Enhancement Fee in FY2020 and differential tuition in FY2025. In FY2021 we began allocating financial aid costs to other funds where appropriate and allowed. However, costs of operating a university have unfortunately grown faster than increases in revenues, due in part to inflationary factors and the continued and rising costs of unfunded federal and state mandates.

How does state funding of higher education impact our fiscal situation?

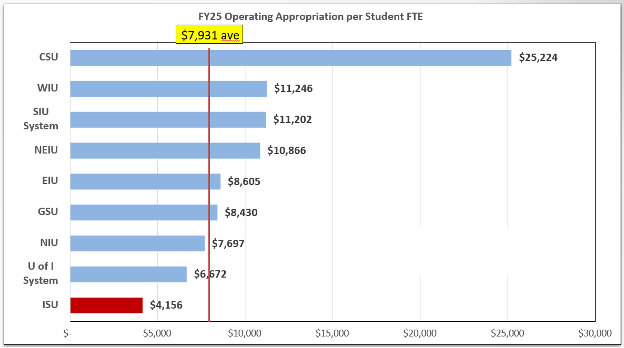

ISU’s FY2025 state appropriation of $79.8 million accounts for less than 14% of the University’s total budget compared to 35% in FY2002 when our appropriation was $92.3 million. Further, after adjusting for inflation, our FY2025 appropriation equates to a purchasing power of $45 million compared to FY2002 funding levels. Additionally, compared to other public institutions in Illinois, Illinois State remains the lowest funded university per-student FTE despite years of advocacy with the state about this imbalance. We have been able to weather this funding structure until now, but rising costs mean this is no longer sustainable.

What are unfunded state mandates?

Unfunded mandates (i.e., state statutes or regulations that require universities to perform certain actions without providing additional financial assistance to cover the expense) cost the University millions of dollars each year. State-mandated waivers alone cost the University more than $12 million annually in foregone tuition and fee revenue.

| Total Awarded | Total Funded | Unfunded Mandate | |

|---|---|---|---|

| Teacher Special Education | $5,767,000 | $5,767,000 | |

| Veterans Grants and Scholarships* | $3,845,000 | $518,900 | $3,326,600 |

| Children of Employees | $2,040,400 | $2,040,400 | |

| ROTC | $510,700 | $510,700 | |

| DCFS | $868,400 | $868,400 | |

| Total | $13,032,000 | $518,900 | $12,513,100 |

*For veterans grants: Illinois Veterans Grants, Illinois National Guard, and MIA/POW grants, partial founding received only received for Fall 2023 semester for MIA/POW grant.

What about the state’s Commission on Equitable Public University Funding?

This Commission was created by PA 102-0570 to recommend “specific data-driven criteria and approaches to the General Assembly to adequately, equitably, and stably fund public universities in this State and to evaluate existing funding methods.” The Illinois Commission on Equitable University Funding found that to fully fund higher education the state would need to invest an additional $1.4 billion over the next 10-15 years. While discussions at the state level are ongoing, there is no guarantee that this investment will materialize.

How can I contribute or get involved in assisting the University with this effort?

Throughout the course of the budget redesign initiative, University stakeholders will have the opportunity to provide input and feedback to project teams and consultants assisting with this effort. The RISE Task Force will also be meeting regularly with Grant Thornton to hear progress, ask questions, and provide input from campus stakeholders. As the project progresses, please talk to RISE Task Force members to learn more or share your thoughts. Additionally, the RISE Task Force has developed an online tool to collect ideas for ways to increase efficiency, reduce expenses, and generate new revenue. We invite you to visit https://illinoisstate.edu/rise and share your ideas for increasing the financial stability of our University. More information and opportunities to provide input and feedback will be shared as our work on this initiative progresses.